I’m going to venture a guess that we’ve all borrowed money to buy something for ourselves: food, clothes, entertainment, cars, houses, etc. The list for some goes on and on….

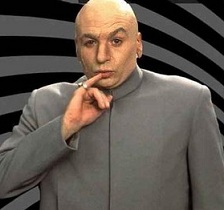

Sure, debt can be great to purchase things like a house that might take quite a lifetime to save up for. But, there is an evil and dark side to debt when it is used without discipline and control. Debt can rule your life if you use it to purchase consumer products that aren’t really “needed” to survive.

I’d like to share a quick lesson with you that I learned at a young age about debt and why instant gratification isn’t all it’s cracked up to be.

How I Learned About the Evil Side of Debt at a Young Age

When you’re a young kid, you scrape together savings any way that you can: birthday money, allowance, and odd jobs around the neighborhood. One day I had put together about $40, and headed off with my mom to the computer game store (Egghead Software back then). I think I was around 13 years old at the time, and playing computer games was one of my main hobbies. There was a game I had heard a little about called Relentless: Twisten’s Adventure. Egghead had the game, and the box art looked great! There was only one small little problem. The game was on sale for $50 and I only had $40 in my wallet.

What was a young 13 year-old to do? Why, I asked my mom to borrow the $10, of course! So I walked over and humbly asked the question: “mom, can I have $10 now and I’ll pay you back next week after I wash the cars?” In those days, I was paid $10 each week by washing and vacuuming out both of the family vehicles – this was basically my allowance.

Her response went something like this: sure you can borrow the $10 now, BUT as repayment for getting the money now you’ll have to wash and vacuum out the cars for two weeks. Hmm… “OK,” I responded without giving it that much thought.

Two Weeks Later

Playing the new computer game was great! I had tons of fun playing it for hours at a time on our old 486. Sweating outside in the hot humid Virginia sun vacuuming out the cars that second week, I realized I had made a pretty bad decision. If I only could have waited one more week, I would still have the computer game, and I could be $10 closer to having enough money for the next one.

I think it was at that moment in time that it really “clicked” for me that borrowing money to get something now is ALMOST ALWAYS a bad idea. Sure, it feels great to get that instant gratification, but the “debt hangover” can be an absolute bitch! Anyone who is in over their head with debt will eventually come to this realization – it’s not a matter of if, but when.

Final Thoughts

The only real exception that I can think of to this rule is buying a house. I think this is mostly because the US government subsidizes housing in order to keep most people under control as debt slaves, but I digress…

For me, learning that debt is not the answer to get what you want out of life came pretty early (thank god). If you are debt free now or on your journey there, when was your “ah ha” moment that you realized debt was not the answer to a happy life?

Great job by your mom to teach you that lesson. Love it!

Pretired Nick recently posted…Dividend mapping: The craziest thing I never did

Yeah, it’s funny that I can remember this from all of those years back. I truly was an awesome lesson!

That debt hangover can be pretty wicked! You can’t just drink some water and have it subside. Great article Derek!

Grayson @ Debt Roundup recently posted…Comment on Encouragement – Spread It Around! by Thomas | Your Daily Finance

I always hated debt when I was younger and my income was smaller, but when I got the highest paying job at that point in my working career something changed. I saw the income as an excuse to borrow more because I could pay it back. It didn’t hurt also that in my mid 20’s was the height of the borrowing credit card craze in this country. Debt Free is the only way I want to live.

Lifestyle inflation is very difficult to combat against when the money begins to roll in unless you’ve thought of very specific financial dreams for yourself and packaged these into goals that you can audit against. I think many fall into this trap without even realizing it.

Great title, very interesting point!

Monica @MonicaOnMoney recently posted…Pay For Your Degree With Cash

Your mom charged you an annualized 3200% interest? Outrageous! Though in the end, a cheap lesson.

Yeah, she was giving those payday lenders a run for their money!!!

I think that as long as you have the potential of increasing your income each year, debt is not the end of the world. However, at one point you have to pay it back!

I’ve been buying a lot of stuff while my income went from 30K in 2003 to 131K last year. Now I’ll be using this extra income to pay off my debts.

The Financial Blogger recently posted…What is Wrong with Your Cubicle?

Holy crap! That’s a huge income boost over the years. Congrats on that!!!

To me, it’s just a question of pay me now vs. pay me later. Everyone has to decide the trade-off for themselves. For instance, is there any of that stuff you bought with debt that you could have waited a year to purchase? Any rough idea how much you’ve lost due to interest payments?

I got myself into some credit card debt when I was 18 that was a real eye opener. It gave me a sense of panic all the time and I felt guilty buying anything. But I’d still do it because I was hooked to instant gratification – I needed things now!

Daisy @ Prairie Eco Thrifter recently posted…Four Weekend Activities that will Rock Your Financial World

Credit card companies seem to prey on the 18-year-olds because they are easy targets to load up with debt. Sorry to hear you got caught in the trap- but it sounds like you made your way out.

It almost seems like Congress should outlaw any type of perk that comes with using credit cards (rewards, sign-up bonuses, t-shirts, etc.) to prevent people from getting hooked on the things, but that would never happen…